Let’s dive in

Money, a global force that guides our decisions and dreams. But the value of money isn’t static – it changes over time. Imagine if someone gave you a choice: would you rather take $100 today or a year from now? Most people would choose the money today, and there’s a reason for that. This intuitive choice stems from an economic principle called “the time value of money.”

The time value of money is just one of the complex factors in finance. For instance, risk, in this context meaning the possibility of a financial loss, is another pivotal element. Every investment or decision carries the potential for higher returns but also the possibility of losses. Additionally, beyond financial return, there’s also the matter of responsibility, which provides a sense of mental well-being to the investor. Less risk usually means calmer mind and nights well slept.

In this post, I’ll dig deeper into these themes and explain why the time value of money is such a central concept in finance and economics. Let’s go!

The Time Value of Money and Financial Risk

The time value of money is a fundamental concept in finance and economics. It embodies the idea that the value of money changes over time, and that the value of a euro today is not the same as its value in the future. This can be attributed to various reasons, such as inflation, expected returns, and other financial factors.

I mentioned about getting $100 today or a year later, so why is it more beneficial taking the money now. More specific reasons behind this decision are:

- We prefer to spend money earlier rather than later. That is just human nature

- Getting the money earlier is 100% sure but how about after a year? The is a risk that you might not get the money after all. Even if promised

- Inflation lowers the purchasing power of money, so that same $100 won’t probably be worth as much after a year as it is right now

The impact of inflation on the time value of money is one of its most significant factors. As the price level rises, the purchasing power of money continuously diminishes. This means that the same amount of money will buy fewer goods and services in the future than it does today. Of course there might also be deflation where the purchasing power increases, but that is very rare and extremely bad situation.

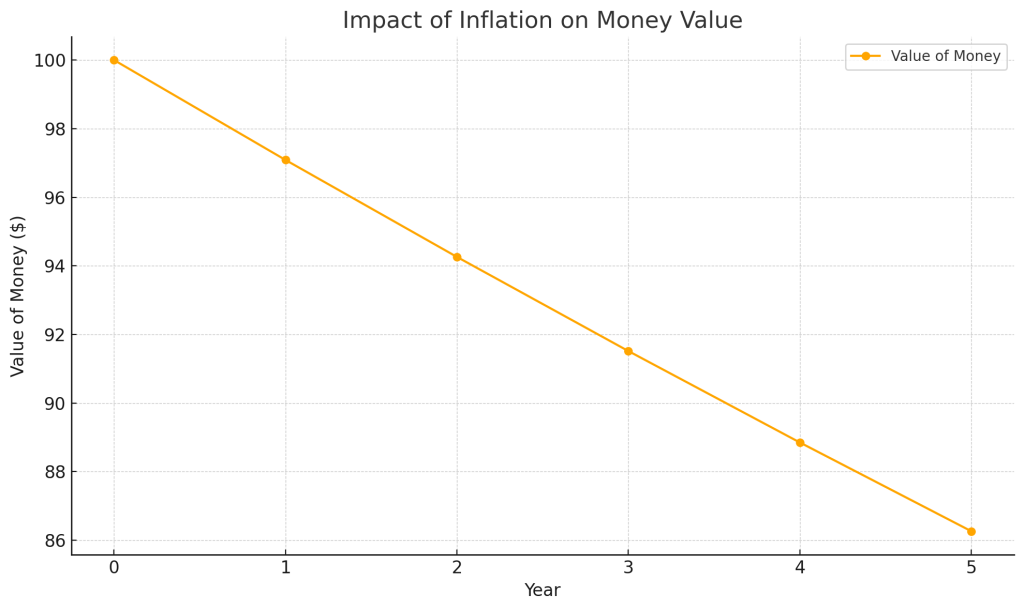

In the chart below you can see how much your $100 would be worth in 1-5 years if inflation is 3%. After five years it’s purchasing power would be $86.26 compared to this moment. You can calculate this in a following way: A/(1+r)^t, where A is the amount of money, r is the inflation rate and t is the time in years. So $100/(1+0,03)^5 = $86.26. While the inflation rate of 3% already takes away almost $14 from the original $100 in five years, you can imagine what the inflation rate of 7-10% in 2022 did to your purchasing power.

Risk is also an integral part of financial decision-making. When an investor considers where to place their money, they always assess the risk involved. A higher expected return might attract an investor, but it also comes with the possibility of greater losses. New and rapidly growing business might appear appealing, but the risk of bankruptcy might also we significantly higher. So if you are less likely to get your money back, you definitely want to get more back than what you loaned or invested. If you think about two people you know. One is your loyal and trustworthy friend and the other one is that unreliable dude who always makes stuff up and gives out empty promises. Would you be willing to loan them both $100 without getting any extra money back?

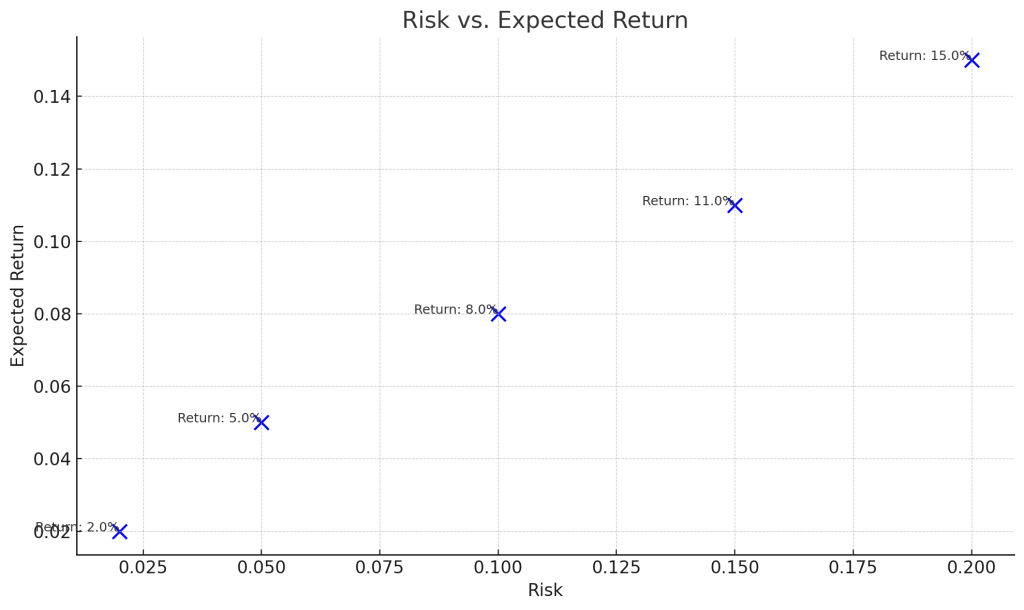

In this second chart there is an example of how expected return correlates positively to the risk level. Expected return means how much profit you would expect, for example if you loaned or invested that same $100 to something with a risk level of 0.20, you would expect to make a profit of $100 * 0,15 = $15. In this example the differences are just few dollars, but if the investment would be $100,000 it would be quite different situation. Risk levels in this chart refer to volatility of the investment. So profits could vary around 20% on average if the risk level is 0.20 like in the example. Lower the risk, lower the volatility, so you are more likely to get what you expect, but your returns are also lower.

Risk-free interest rate and opportunity cost

Risk-free and profitable investment seems too good to be true, and theoretically it is. But! Risk-free rate is a fundamental concept in finance and economics. While risk-free means that the entity responsible for the return has no chance of being unable to make the promised payments, governments of stable countries are often seen as this kind of 100% reliable loan payer. And why does this matter? Governments offer bonds (we will cover them better later) for different time spans. Almost always the rate is higher if the time span is longer. This basically means that you can loan your money to governments and they pay you interest depending on the rate of these bonds.

For example if you buy U.S. Treasury 10-year bond and it’s rate is right now 5%, you will get 5% of your invested paid to you every year, basically risk-free. Let’s say you invest $10,000, so U.S. government will pay you $500 every year until the bond expires 10 years later. This risk-free rate is constantly changing depending on the economical situation, but your bonds rate won’t change during the investment.

As individual investors and companies consider where to invest their money, they use these risk-free rates as a benchmark, because why would they accept the same return from risky investments if they can get the same return risk-free, right? So if there is nothing else, then the money available would perhaps be wise to invest in bonds. This is also one factor when talking about the time value of money. Let’s say there is no inflation at all and you keep your money in the bank. Most people would say they have the exact same amount of money and that of course is true. However in financial point of view you would see that as a loss, with an amount similar to the profits you would have had from bonds because they are risk-free.

You could have for example 5% more money from bonds risk-free, so you kind of “lost” that amount. With $10.000 that would mean the same $500 as before. This is called an opportunity cost, as you had two options, keeping the money in the bank or investing it in bonds, and you took the worse one. Of course in reality that is not so simple and you shouldn’t invest all of your money in case you need some money. Even though this is pretty theoretical at some cases it’s still very important to understand if you want to become a successful investor and make better decisions with your money. This is especially important in investing decisions and calculations, where risk-free rate is often used as a discount rate when calculating future cash flows. However to keep these posts compact enough I think it’s better to go through discounting in another post. That together with inflation make everything a little bit more complicated

Summing it up

The time value of money is really a central concept that influences many financial decisions, whether it’s about investing, borrowing, or saving. It signifies the idea that the value of money isn’t static but changes over time due to factors like inflation and expected returns. Especially during these crazy recent years its even more important to take into account..

As an investor it’s really important to understand how all this binds together. I did this mistake of not learning about time value of money and risk-free rates until I had already invested for a few years, so I was basically doing my decisions half blind. Just the idea that you should always have your money growing somewhere, at least in the risk-free bonds, so that it won’t be just lying on your bank account losing it’s value over time is very very important. I hope you got something out of this that makes you a better investor.

I also hope this first real blog post is seen as successful and useful for whoever happens to read it. I’m trying hard to get more posts out to get this thing really going. Thank you for reading and I hope to see you again!

Leave a comment